Saving for a Down Payment?

One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down.

That doesn’t necessarily have to be the case and one of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership

Below are the programs avaliable for a down payment on a typical loan program.

if you are using a foreign National pogram that will required a larger down payment.

Each program does have a different down payment depending on the individual .

Having a credit score above 580 will take you to own your future home.

Categories

Recent Posts

US Buying Your First Home? FHA Loan Might Be Your Best Option

¿Eres primer comprador? Conoce el préstamo FHA: tu mejor aliado para comprar casa en EE.UU.

Florida Is Booming — Here's Why Investors Are Paying Attention

¿Por qué todos quieren invertir en Florida? Las cifras lo confirman.

Confused about the mortgage process? You're not alone (and here's how to fix it)

¿Confundido con el proceso de hipoteca? No estás solo (y aquí está cómo solucionarlo)

Hometown Heroes 2025: The perfect opportunity to buy your first home in Florida

Hometown Heroes 2025: La oportunidad perfecta para comprar tu primera casa en Florida

7 tips to save for down payment and buy your house

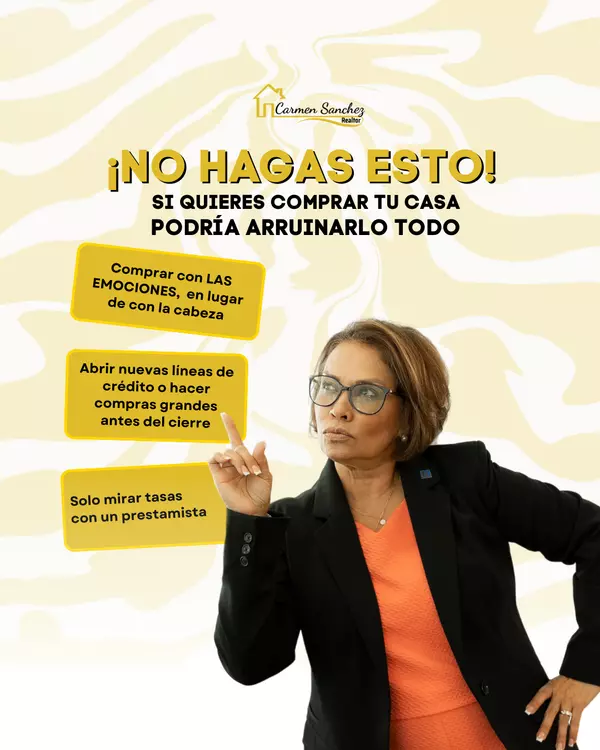

"3 errores que pueden arruinar la compra de tu primera casa (y cómo evitarlos sin perder la cabeza)