Confused about the mortgage process? You're not alone (and here's how to fix it)

Did you know that 1 in 3 renters have put off buying their home simply because they don't fully understand how a mortgage works?

A recent survey by JW Surety Bonds revealed that many prospective homebuyers in the U.S. have low financial literacy about the home buying process, and it's costing them time, money and opportunity.

As a real estate agent specializing in first-time buyers in Florida, this doesn't surprise me...but it does confirm something for me: my job is also to educate, not just sell.

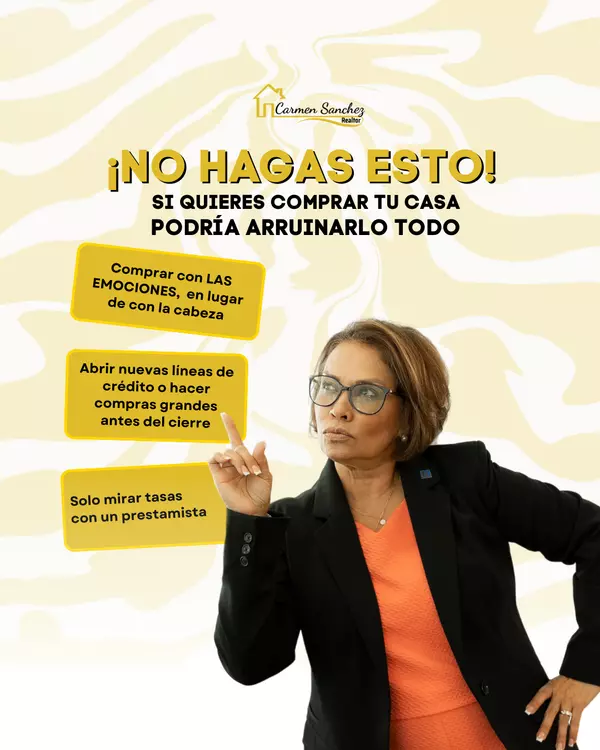

🚨 Top financial mistakes home buyers make (and how to avoid them!)

📌 Not knowing what a mortgage is or how the rate works

Yes, believe it or not, 1 in 8 buyers don't know what a mortgage is, and 43% don't understand the term “mortgage rate.” This is serious considering most buyers finance their home with a loan.

📌 Not comparing loan options

Over 40% of buyers didn't feel confident negotiating their interest rate or shopping for other financing options. And that could cost them up to $76,410 more during the loan!

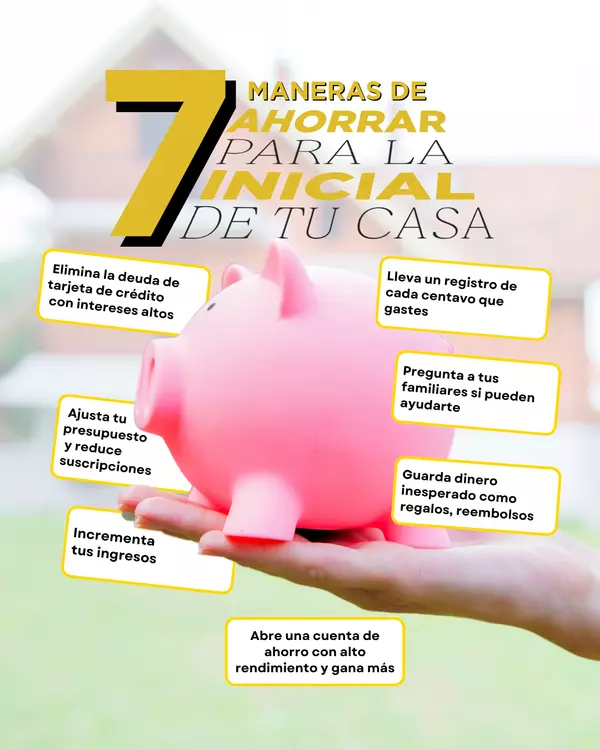

📌 Not calculating the hidden costs of homeownership

Expenses such as maintenance, taxes, insurance or HOA dues often come as a surprise to many. Twenty-seven percent of homeowners say they didn't have these in mind when they bought. This can lead to spending more than 50% of your monthly income on housing. 😱

📌 Not having an emergency fund

Nearly 4 in 10 buyers have no savings for contingencies such as urgent repairs or emergencies. Something as simple as a broken pipe can turn into a major financial headache.

Where are buyers looking for answers?

According to the survey, the most commonly used sources are:

- Friends and family (64%)

- Articles and blogs (49%)

- Real estate agents (31%)

- YouTube (29%)

- Financial advisors, courses and TikTok

This reinforces the importance of us agents being present on social networks, blogs and educational events, sharing reliable and accessible content.

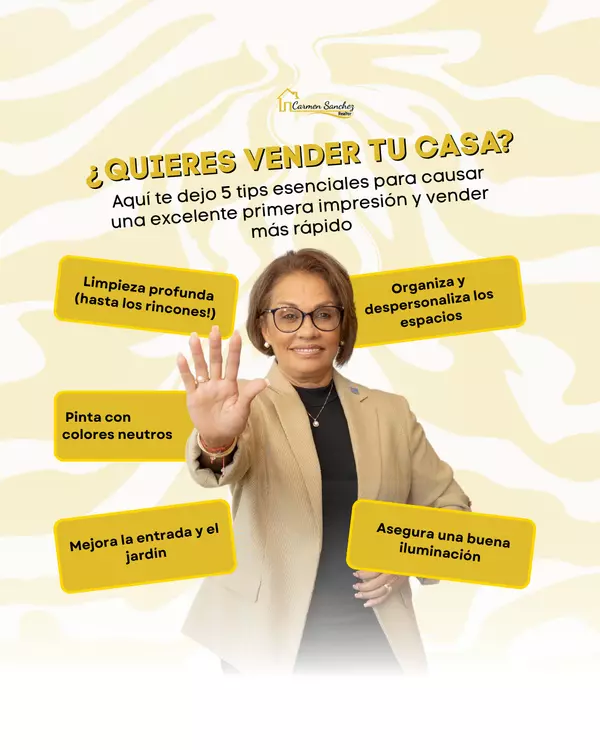

How can I help you as your REALTOR?

✅ I explain financing options (like FHA, VA and low down payment loans) in plain language

✅ I give you tools to plan your budget and not get surprises

✅ I walk you step-by-step from pre-approval to closing

✅ I can connect you with trusted experts like lenders or financial advisors

🔑 The key is not just buying a house. It's buying it with knowledge and security.

If you're thinking about taking the plunge into your first home, don't let fear or lack of information hold you back. email me! I'm here to help you become a confident homeowner.

Categories

Recent Posts