Did you know that you can qualify for your ideal home with alternative income?

If you have a pension, insurance income or are self-employed, don't worry! You can also fulfill the dream of being an owner.

Although many think that it is necessary to have a traditional income to obtain a mortgage, the reality is that the essential thing is to demonstrate stability and consistency in income. Lenders look for assurance that you will be able to meet your payments, no matter where your cash flow comes from.

So, don't let myths limit you!

Contact me to provide you with more information.

Categories

Recent Posts

US Buying Your First Home? FHA Loan Might Be Your Best Option

¿Eres primer comprador? Conoce el préstamo FHA: tu mejor aliado para comprar casa en EE.UU.

Florida Is Booming — Here's Why Investors Are Paying Attention

¿Por qué todos quieren invertir en Florida? Las cifras lo confirman.

Confused about the mortgage process? You're not alone (and here's how to fix it)

¿Confundido con el proceso de hipoteca? No estás solo (y aquí está cómo solucionarlo)

Hometown Heroes 2025: The perfect opportunity to buy your first home in Florida

Hometown Heroes 2025: La oportunidad perfecta para comprar tu primera casa en Florida

7 tips to save for down payment and buy your house

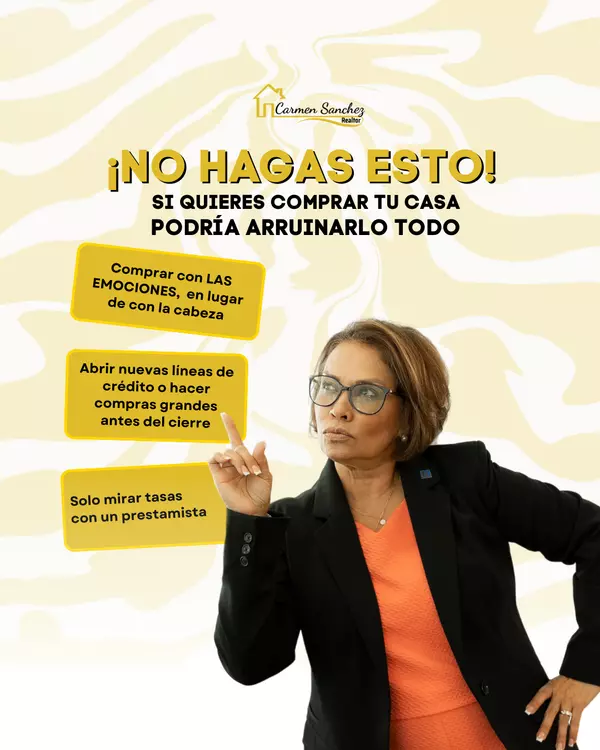

"3 errores que pueden arruinar la compra de tu primera casa (y cómo evitarlos sin perder la cabeza)